Global growth no longer depends on being big—it depends on being fast. The Global Payment App from OnlineCheckWriter.com – Powered by Zil Money makes that speed possible.

Expanding across borders isn’t just about signing contracts—it’s about making sure money moves as smoothly as the deals themselves. Yet for years, cross-border payments created more problems than solutions. Sending funds from the U.S. to Europe, France, Germany, Estonia, or even Asia and India often meant long delays, unexpected fees, and constant uncertainty about whether the payment would arrive on time.

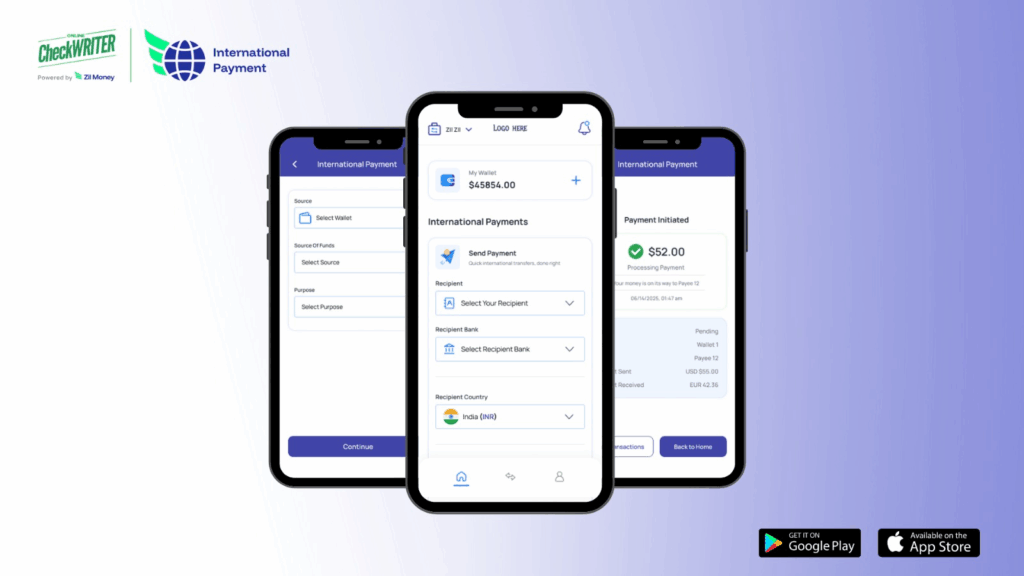

In 2025, that’s changing. The Fast International Payments app from OnlineCheckWriter.com – Powered by Zil Money eliminates those barriers by offering a faster, more transparent way to send money worldwide. What once took days now takes minutes, giving businesses the confidence to grow globally without the weight of outdated systems holding them back.

Why the Old Way Doesn’t Work Anymore

Let’s face it—traditional international payments were never built for today’s pace of business.

- Delays: Transfers crawled along for 3–5 business days, often at the worst possible time.

- Hidden charges: Surprise deductions meant suppliers received less than expected, souring partnerships.

- Complex setups: From pre-funded accounts to paperwork piles, everything took more effort than it should.

For small and mid-sized companies trying to expand globally, these old systems felt like running a sprint with weights strapped to their legs.

Enter the Mobile-First Era

The real shift today isn’t just “faster payments.” It’s the freedom to handle every international transaction from the phone in your pocket.

The Fast International Payments app—available on both the Play Store and App Store—lets you:

- Pay vendors, suppliers, and freelancers in minutes.

- Lock in competitive currency rates without guesswork.

- Keep every dollar working for you until the moment you send it.

It’s speed, yes—but it’s also visibility, control, and transparency rolled into one.

Four Breakthroughs That Redefine Cross-Border Payments

Think of this app as a toolkit designed for business growth. Here’s how it’s reshaping global payments step by step:

1. Money That Moves in Minutes

Instead of waiting days for suppliers in India or Europe to receive funds, payments now arrive almost instantly. That means projects don’t stall, and trust grows stronger with every transaction.

2. Fair Pricing, No Surprises

With this app, what you see is what you pay. Gone are the days when hidden fees shaved value off your payments. Transparent pricing keeps every transaction clean and predictable.

3. No More Pre-Funding Traps

Many international systems force you to tie up cash in overseas accounts. This app doesn’t. Payments come directly from your wallet, leaving your funds available and under your control until you hit “send.”

4. Competitive Exchange Rates That Protect Margins

Every business knows how fast currency fluctuations can eat into profits. By offering strong, fair exchange rates, the app helps ensure your global deals stay profitable.

Why This Matters for Business Owners in 2025

Going global doesn’t just require ambition—it demands tools that keep pace with opportunity. Business owners adopting mobile-first international payments gain:

- Freedom to act anywhere: Handle global payouts while traveling, at a client site, or between meetings.

- Peace of mind: Security and compliance are built in, so you’re not gambling with sensitive data.

- Room to grow: Fewer manual steps mean more energy for strategy, not paperwork.

Put simply, this isn’t just about faster payments—it’s about smarter ones.

Beyond Speed: What Really Sets It Apart

Almost every fintech today promises “fast.” But speed alone isn’t a differentiator anymore. What sets this platform apart is the balance of speed, transparency, and control.

With the Fast International Payments app, businesses aren’t forced to choose between quick transfers and affordable, secure ones. They finally get both.

Payments as a Growth Strategy, Not Just a Task

Here’s the bigger picture: international payments are no longer just a back-office process. They’re becoming a front-line growth strategy. Each smooth transaction builds credibility with suppliers, strengthens partnerships abroad, and positions businesses for expansion into new markets.

In 2025, agility beats size. Businesses that adopt mobile-first payment solutions will outpace those that stick with outdated systems. The choice is simple—keep waiting on old rails or move forward on faster, smarter ones.

Unlocking New Opportunities

This isn’t about downloading yet another app. It’s about unlocking access to opportunities once blocked by delays, hidden fees, and outdated processes.

The Fast International Payments app from OnlineCheckWriter.com – Powered by Zil Money is live right now on the Play Store and App Store. The real question isn’t whether you’ll try it—it’s how much growth you’ll leave behind if you don’t.

Download it today and take your first step toward borderless business.

FAQs:

What makes this app different from traditional cross-border payment systems?

It processes international payments in minutes, with no hidden fees and fair exchange rates—all from one simple mobile app.

Is it secure for sensitive transactions?

Yes. The app uses encryption and compliance standards to ensure every transaction is safe and reliable.

How can I access the app?

It’s available now on both the Google Play Store and Apple App Store, giving you full global payment control from your phone.